capital gains tax canada 2020

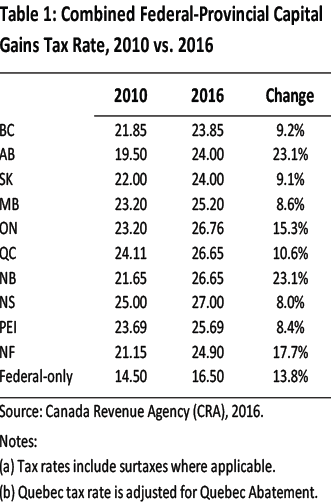

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. Canada Revenue Agencys CRA.

Capital Gains Tax In Spain Do I Need To Pay It And How Much

For example in the UK the CGT is currently tax year.

. The amount of tax youll pay. There is no special capital gains tax in Canada. You will find a copy of this schedule in your Federal Income Tax and Benefit Guide package.

In Canada 50 of the value of any capital gains is taxable. The 2020 edition of Final Statistics presents data based on 2018 tax year returns filed and processed up to June 30 2020. HTML t4037-ehtml PDF t4037-21epdf For people with visual impairments the following alternate formats are also.

You can apply 12 of your capital losses against any taxable capital gains in the year. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. The most recent assessment is.

If the assets were held for two or more years the gain will be taxed as a capital gain at a 10 flat rate recapture rules are applicable. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the. You may be entitled to an inclusion rate of zero on any.

For more information see Losses and deductions. And the tax rate depends on your income. Because you only include one half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of a LCGE of.

Your adjusted cost base was 400000 so your total capital gains is 100000 and your taxable capital gains is 50 of that or 50000. 5000-S3 Schedule 3 - Capital Gains or Losses for all For best results download and open this form in Adobe Reader. For now the inclusion rate is 50.

See General information for details. The tax rate of the capital gains tax depends on how much profit you gained and also on how much money you make annually. T4037 Capital Gains 2021 You can view this publication in.

If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing. In our example you would have to include 1325 2650 x 50 in your income. Capital gains tax rate In Canada.

Only 50 of your. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. For a Canadian who falls in a 33 marginal.

The taxable capital gain for the land. For information on how to calculate your taxable capital gain go to Line 12700 Capital gains. The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

Colombia Last reviewed 08 August 2022 10. This means that only half of your capital. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

Instead capital gains are taxed at your personal income tax rate. The capital gains deduction limit on gains arising from dispositions of QSBCS in 2020 is 441692 which is half of a LCGE of 883384. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Capital Gains Implications Of Gifts Other Transactions

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law Firm

Engineeringrobo S Cryptocurrency Stock Tax Guide Engineeringrobo

Canadian Dividend Tax Credit Inquiry R Canadianinvestor

How Tax Rates In Canada Changed In 2022 Loans Canada

Canada Crypto Tax The Ultimate 2022 Guide Koinly

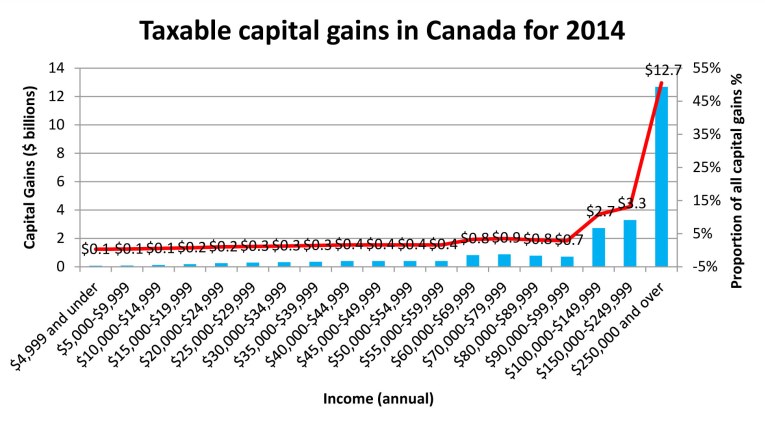

Too Many Analyses Misrepresent Capital Gains Income And Taxes Fraser Institute

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Corporate Tax Rates Around The World Tax Foundation

As An American Living In Canada Do I Need To File Tax Returns In Both Countries

Opinion Biden S Capital Gains Tax Hike Is His Fourth Hit On The Rich Marketwatch

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us