are charitable raffle tickets tax deductible

The IRS has determined that purchasing the chance to win a prize has. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

Ticket Events Set Tax Deductible Amounts Givesignup Blog

However the answer to why raffle tickets are not tax-deductible is quite simple.

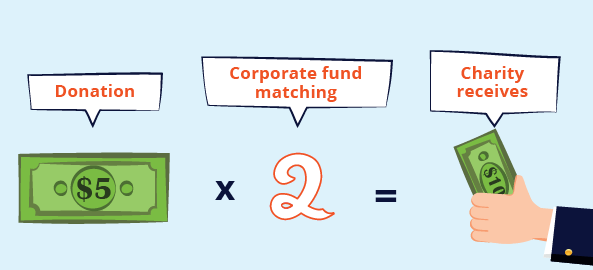

. Buying a ticket lets you help your community but it doesnt help you claim a deduction for a charitable donation. A gala dinner costs 100 per person for. Dues to fraternal orders and similar groups.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift. The IRS classes money spent on raffles and lotteries as contributions from which you benefit and therefore it is generally not deductible. Tuition or amounts you pay instead of tuition.

You cannot claim 120 if you only paid 40 during the year. To claim a deduction you must have a written record of your donation. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. The donor must be able to show however that he or she knew that the value of the item was less than the amount paid. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Your state may or may not permit charitable nonprofits to conduct raffles Bingo auctions and other games of chance. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling.

For specific guidance see this article from the Australian Taxation Office. How much of a charity event ticket is tax-deductible. Raffle or art union tickets for example an RSL Art Union prize home items such as chocolates mugs keyrings hats or toys that have an advertised price.

Charity Auctions Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market value. However you must be 18-years of age or older to purchase raffle chancestickets. The gift thats not a gift.

Are raffle tickets tax deductible. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a charitable donation. This might sound nonsensical on the surface.

That pledge you made doesnt become deductible until you actually give the money. If it does it is likely your nonprofit will need to apply for a license from the state beforehand. LANGUAGE FOR TICKET PURCHASE FORM.

The IRS regulates games of chance too as well as the taxable income that is earned by victorious game-players. When you agree to contribute 10 per month during a fund-raising drive only the monthly payments you make during the tax year can be deducted on that years return. If you win the raffle you may even end up owing tax.

In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. The purchase of a raffle ticket is not considered a charitable donation. If you get something in return for your donation such as a raffle ticket thank-you card or ribbon its not considered a gift and you cant claim it.

What you cant claim You cant claim gifts or donations that provide you with a personal benefit such as. There is the chance of winning a prize. Donations to crowdfunding appeals often arent tax deductible because you often get some reward the fundraising might be for a number of people or groups or its for medical costs.

This is because the purchase of raffle tickets is not a donation ie.

Tax Compliance For Nonprofit Event Fundraising Infographic

Silent Auction Receipt Template Fresh Charitable Contribution Receipt Letter Template Silent Donation Letter Donation Letter Template Receipt Template

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

Tax Deductible Donations An Eofy Guide Good2give

Https Www Brighthub Com Office Home Articles 106591

501c3 Tax Deductible Donation Letter Template Business

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic S Blog

Are Raffle Tickets Tax Deductible The Finances Hub

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Using The Donation Receipt Template And Its Uses

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic S Blog

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors