kentucky sales tax on-farm vehicles

The deadline for farmers to obtain their agriculture exemption license number has been extended. The agriculture exemption number is valid for three years from the.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax On Cars And Vehicles In Kentucky.

. Vehicle rental excise tax Instead of implementing a rental tax on motor vehicles Kentucky charges a motor vehicle. To ensure the tax collected from the sale of motor vehicles to residents of states which do not allow Kentucky residents to purchase motor vehicles without paying that states. You can easily access coupons about Kentucky Sales Tax On Farm Vehicles Silvana Eckert by clicking on the most relevant deal below.

You can download a PDF. Exempt from weight distance tax in Kentucky KYU. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960.

For example Kentucky exempts from tax feed farm. The retailer must collect Kentuckys 6-percent sales tax on the fee. KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents 003 per kilowatt.

Kentucky Sales Tax Rate - 2022. Kentucky Sales Tax Guide - Chamber Of. The deadline to apply for the new agriculture exemption number for current farmers is January 1 2022.

Several exceptions to this tax are most types of farming. 650 Definitions for KRS 186650 to. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kentucky sales tax.

650 Definitions for KRS 186650 to. The state of Kentucky has a flat sales tax of 6 on car sales. HB 487 effective July 1 2018 requires.

For Kentucky it will always be at 6. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. Kentucky does not charge any additional local or use tax.

KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power. You can easily access coupons about Kentucky Sales Tax On Farm Vehicles Aurora Perreault by clicking on the most relevant deal below. How to Calculate Kentucky Sales Tax on a Car To calculate the.

In the state of Kentucky legally sales tax is required to be collected from tangible physical products being sold to a consumer. Kentucky Sales Tax Rate - 2022.

Motor Vehicle Taxes Department Of Revenue

How To File And Pay Sales Tax In Kentucky Taxvalet

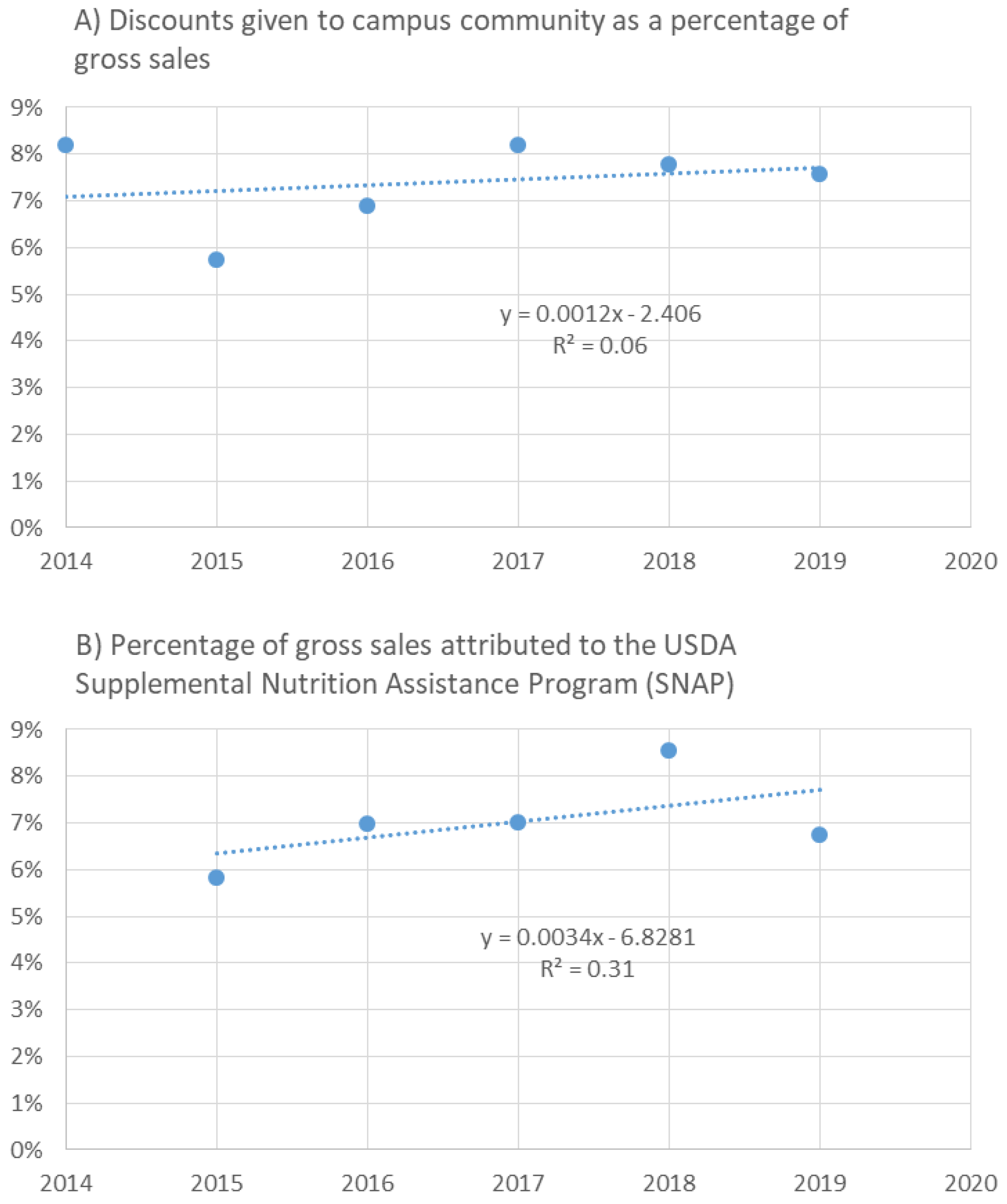

Sustainability Free Full Text Financial Viability Of An On Farm Processing And Retail Enterprise A Case Study Of Value Added Agriculture In Rural Kentucky Usa Html

What Transactions Are Subject To The Sales Tax In Kentucky

Ag Prepares For Electric Powered Future

Sustainability Free Full Text Financial Viability Of An On Farm Processing And Retail Enterprise A Case Study Of Value Added Agriculture In Rural Kentucky Usa Html

Missouri Sales Tax Exemption For Agriculture Agile Consulting

Ford Brothers Fall Farm Machinery Vehicles Equipment Recreational Vehicle Online Consignment Auction

10 Farm Tractor Salvage Yards In Kentucky 2021 Farming Base

Sustainability Free Full Text Financial Viability Of An On Farm Processing And Retail Enterprise A Case Study Of Value Added Agriculture In Rural Kentucky Usa Html

Ky Farmers Required To Apply For New Sales Use Tax Exemption Number News State Journal Com

Kentucky S Car Tax How Fair Is It Whas11 Com

Best Cheap Car Insurance In Kentucky 2022 Forbes Advisor

Answers To Common Agriculture Tax Exempt Questions Lifestyles Somerset Kentucky Com

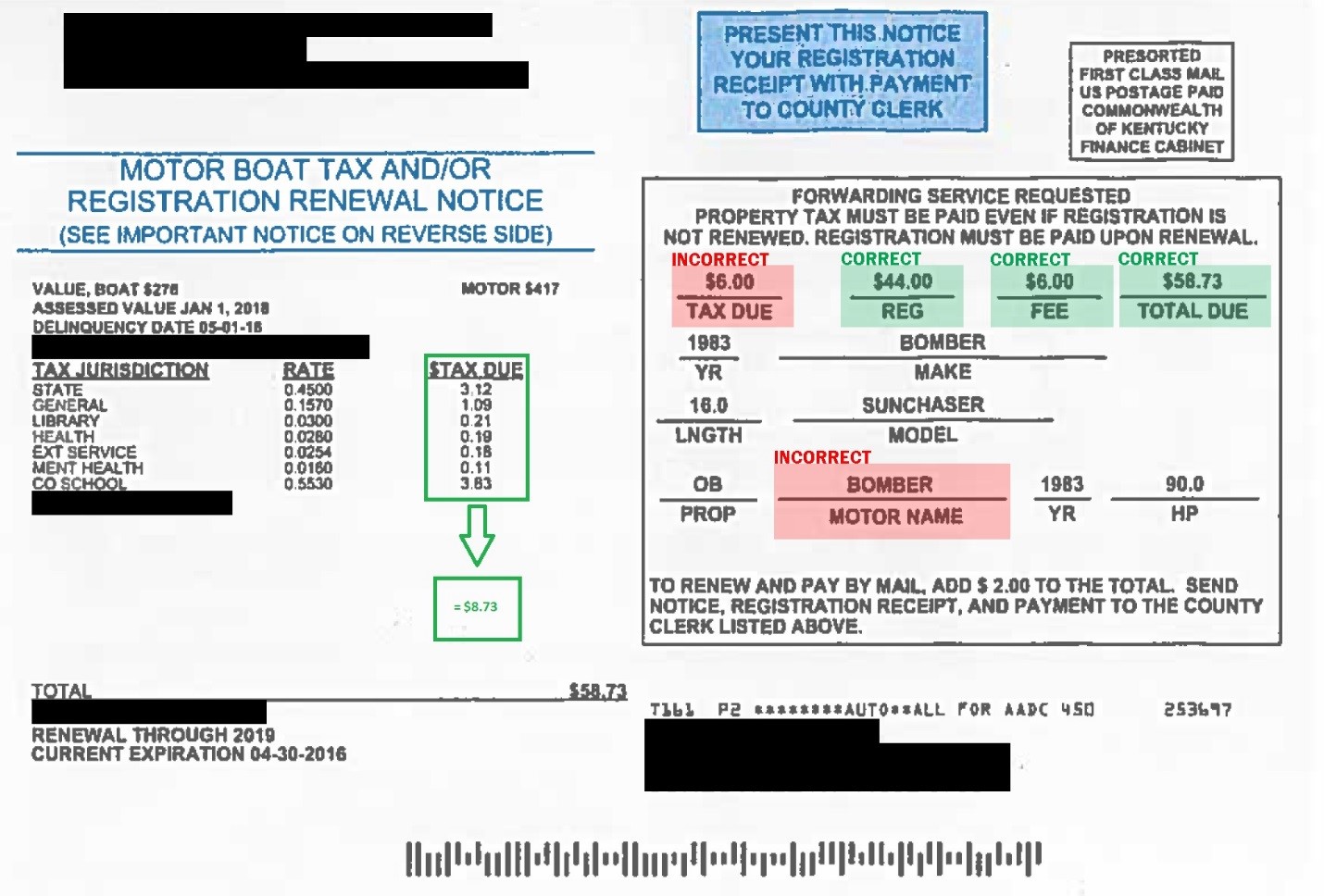

Motor Boat Tax And Registration Renewal Notice Information Department Of Revenue

Illinois Sales Tax Exemptions On Farm Equipment

Kentucky Hurting While Awaiting Federal Pandemic Aid The New York Times